Meet Our OTT/CTV Advertising Platform

Welcome to our Blog Series! We’re excited to share regular updates with you about a particular facet of our holistic omnichannel OTT/CTV advertising platform.

This week, we’re joined by James Morris, one of our talented Product Managers. James oversees our OTT/CTV advertising platform, and is here to talk about some of its many unique features.

Hi James! Thanks for joining us. First up, can you tell us the difference between OTT and CTV?

My pleasure! Happy to be here.

OTT (“over-the-top”) is simply video streaming content that viewers consume via the internet (rather than broadcast/cable/satellite). This can be on any internet-connected device. This term is typically used to refer to video streaming on mobile phones, tablets, and desktop computers/PCs. So, if you’re watching TV shows from your favorite streaming platform on an app on your iPhone, that’s OTT.

CTV, or connected TV, simply refers to OTT content that viewers watch on a TV. In other words, this is video streaming via the internet using a TV as a medium. Whether we are talking about a Smart TV, streaming stick, set top box, screencast, or gaming console, it’s considered CTV. So if you’re watching TV shows from your favorite streaming platform on your TV via your Roku, that’s CTV.

Can you tell us a little bit about the challenges faced in the OTT/CTV space?

Unfortunately, the OTT/CTV space is pretty messy from a fragmentation perspective. You also still have widespread issues in regards to ad fraud, cross-device buys inefficiently executed across many demand types (programmatic open auction, PMPs, direct buys), and inconsistent cross-device campaign measurement.

We’ve built our platform to help minimize these challenges. For example, we’ve eliminated Server-Side Ad Insertion fraud by building a free SSAI service in house. We do all of our dynamic ad insertion without connecting to third-party vendors. This saves our publishers money while eliminating the risk of ad fraud. Our market quality technology also runs alongside our SSAI. This helps immediately detect and eliminate both supply and demand side fraud behaviors.

With that in mind, what does the market look like today?

From a fragmentation perspective, you have publishers (streaming platforms, TV networks, broadcasters, etc.) working separately with all of the following parties:

- Video player solution

- Ad server or exchange

- SSP demand sources (usually via OpenRTB or VAST tags)

- Header bidding wrappers (usually via OpenRTB or Prebid Server)

- SSAI/DAI vendors

- Content providers (either non-O&O VOD or live broadcaster partners)

- Third party quality and viewability measurement vendors

This results in an overly-complicated ecosystem that opens up the opportunity for ad fraud, discrepant measurement and reporting, and black boxes. It urgently requires consolidation.

From a cross-device buys perspective, you have publishers requiring their ad pods (commercial breaks) to be filled with open auction, private marketplace, preferred deals, or programmatic guaranteed deals, or by direct advertisers, local advertisers, and house ad demands – all in a way that maximizes their platform’s ad monetization. The problem is, most publishers use separate platforms to handle each of these demand types. This makes it difficult for publishers to efficiently manage their inventory. So, there is a huge opportunity for consolidation here.

Finally, from a cross-device measurement perspective, you have buyers executing ad campaigns across mobile, web, and CTV (all the frontiers of OTT), attempting to reach as many viewers as possible. Of course, they also want to be efficient with their ad dollars. You don’t want to show a viewer an ad on TV that they already saw on their mobile device earlier in the day). With the myriad of supply paths out there, this is becoming increasingly complicated. Here, it is important that buyers evaluate campaign performance across content identifier and bundle combinations. This is impotant so that a) repeat views are minimized across platforms and b) buyers can make their campaigns most timely and contextually relevant across platforms.

What’s the difference between per-pod and per-slot bidding? Why does it matter?

Per-slot bidding is simply holding an auction on the ad slot (individual commercial) level, which helps maximize ad performance revenue for each commercial in a commercial break. Demand sources have an opportunity to compete for each commercial. This looks like the following:

- A bid request with a single impression opportunity goes to demand sources for each and every slot in an ad pod

- A direct advertiser, local advertiser, or house campaign can be considered for each and every slot in an ad pod

This is currently how most platforms on the market monetize VOD and Live Linear commercial breaks.

Per-pod bidding is simply holding an auction on the ad pod (full commercial break) level, to try to maximize ad performance revenue for the entire commercial break. This takes into account factors like revenue-per-minute – after all, time is money in OTT. Demand sources have an opportunity to compete at the whole pod level, to buy impressions as a pod, in addition to as individual impressions, as follows:

- a bid request with multiple impression opportunities goes to demand sources for each ad pod presented during a user’s viewing session

- a direct advertiser, local advertiser, or house campaign can be considered for the entire ad pod

This is where the industry should move towards, in regards to ad pod monetization. Support is still few and far between, when this method has a variety of buy-side benefits: more visibility, larger area to compete, more time/revenue optimization, better for QPS, and much more.

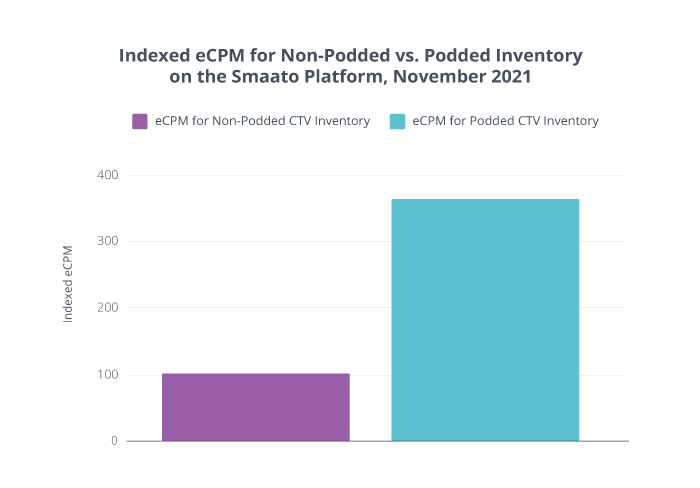

On the Smaato platform, we’ve seen that per-pod bidding helps generate more revenue for publishers.

In November alone, eCPMs for podded inventory were more than triple non-podded inventory.

click to enlarge

What are you most excited about when it comes to the future of OTT/CTV Advertising?

I’m most excited about the efficiencies offered by consolidation. I think that we are going to see groundbreaking consolidation in the OTT/CTV space like we are currently observing in the mobile advertising space. We are truly seeing an “in-app boom” (mobile and CTV) now, comparable to what we saw with the dot com boom in the early 2000s. As this sector starts to come together, we are going to see advertising platforms with capabilities we never thought possible.

I’m also excited about the future of contextual advertising and driving towards better experiences in OTT/CTV. That includes content-granular ad relevance, content-level targeting (by in-content keywords or genre), shoppable CTV, and shorter, more snackable commercials that communicate brands’ messaging while still keeping the viewer engaged in the content.

What’s your favorite feature on the Smaato OTT/CTV Platform?

My favorite thing about the Smaato platform is the amount of controls we offer publishers in regards to ad podding and ad break scheduling. One feature of our platform is that publishers can build linear or non-linear ad pods – controlling demand sources, duration, bidding, skippability, and more – and schedule exactly when they want these shown in their VOD or Live Linear content.

But more than anything, I’m proud of the consolidation that Smaato’s OTT/CTV platform has been able to achieve in the past year:

- Built-in server-side ad insertion (SSAI)

- Ad podding

- Ad pod monetization (OA, PMP, PD, PG, Direct, Local, and House; VAST tag mediation and Prebid-powered header bidding)

- Full monetization platform (ad server, ad exchange, SSP)

- Content Management and Content-Level Reporting

- Built-in quality and measurement technologies

By bringing this all together in one ott/ctv advertising platform, we help our publishers more efficiently manage their inventory and monetization strategy all in one place.

Can you tell our audience something they might not know about what our OTT/CTV Advertising Platform offers?

We have content-level reporting! Our publishers can evaluate their ad performance on each of their movie titles, broadcasts, TV shows, and more. This is useful when comparing licensing fees for each piece of content with your ad performance and average viewers for each content. With this information,you can keep your streaming platform or network profitable, while also keeping it lean and removing content that is not viewed or does not provide you with a strong ROI.

Any big updates for 2022?

We aren’t stopping at OTT Video. Smaato will introduce all of its OTT features for OTT Audio as well soon! Audio streaming platforms, music services, podcasts, and digital radio stations will now be able to monetize using the Smaato OTT/CTV Advertising Platform, in addition to their TV counterparts, with features such as Audio Ad Insertion, Audio Ad Podding, and more!

Thanks, James, and thank you all for tuning in! Stay tuned for more great content in our continued OTT/CTV Blog Series.

Want to learn more about all things OTT/CTV? Check out our complimentary eBook, which dives into all kinds of detail on current OTT/CTV advertising trends, the future of OTT/CTV advertising, and strategies for monetizing OTT/CTV inventory.